Builders merchants have experienced a fall in sales, over the same period last year, but lightside bucked the trend finds the BMBI report from the Builders Merchant Federation (BMF).

According to figures for Q2 2023 published in the latest BMF Builders Merchants Building Index (BMBI) show a fall in both volume and value sales.

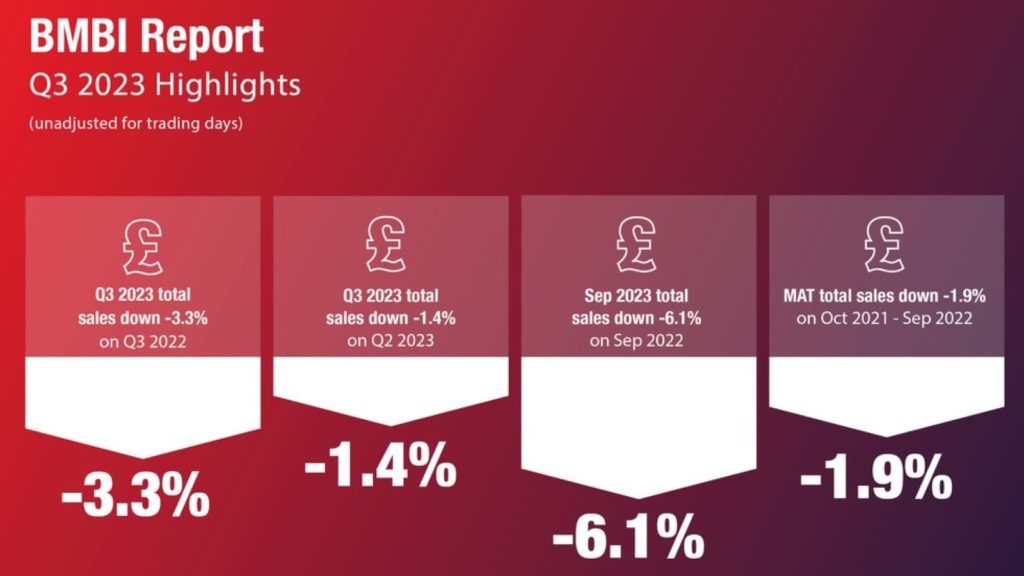

It reports overall Q3 2023 volumes fell by 10.5% compared to Q3 2022, while year-on-year total value sales for Q3 were down by 3.3%, with prices rising 8.0%.

Sponsored Video

On a category level, Timber & Joinery contributed most to the Q3 decline in sales value, down 13.1%.

But all three of the largest categories sold less with Landscaping down by 7.0% and Heavy Building Materials down by 1.5%.

However, all the lightside categories saw value growth with Decorating up by 10.5%, Plumbing Heating & Electrical grew 9.1% and Tools was up 9%.

The BMF states in most instances value growth was also underlined by positive volume performance.

Comparing sales in Q3 2023 with the second quarter of the year, total value sales dipped by 1.4% in Q3 and volume sales dropped by 2.1%, with prices up by 0.8%.

With four more trading days in the most recent quarter, like for like sales were 7.5% lower in Q3 over Q2 2023.

Once again, Lightside categories fared best, with Kitchens and Bathrooms seeing value growth of 7.5%, Workwear & Safetywear was up 4.9% and Decorating grew 3.1%, likely helped by a stronger performance in RMI work.

Over the last 12 months, the BMF states volume sales dropped by 3.0% while prices rose by 12.8% and value sales were down by 1.9% on the same 12 month period in 2021-22.

CEO of the Builders Merchants Federation John Newcomb said: “It has been another challenging quarter for the construction industry, particularly for the housebuilding sector and we can see this reflected in the Q3 BMBI results.

“Domestic RMI work has held up over the year providing some good news, but with higher interest rates set to remain the norm, it may be some time before the market returns to volume growth.”